Kudos has partnered with CardRatings and Red Ventures for our coverage of credit card products. Kudos, CardRatings, and Red Ventures may receive a commission from card issuers. Kudos may receive commission from card issuers. Some of the card offers that appear on Kudos are from advertisers and may impact how and where card products appear on the site. Kudos tries to include as many card companies and offers as we are aware of, including offers from issuers that don't pay us, but we may not cover all card companies or all available card offers. You don't have to use our links, but we're grateful when you do!

715 Credit score: What You Need to Know in 2025

July 1, 2025

TL;DR

A 715 credit score is a solid financial achievement, putting you in a great position for loan approvals. This score falls squarely within the "Good" range on the FICO scale, opening up favorable interest rates and terms.

What Does a 715 Credit Score Mean?

A 715 credit score places you firmly in the "good" range on the FICO scale, which runs from 300 to 850. Lenders typically see individuals with scores like this as dependable borrowers, increasing your chances of approval for credit cards and loans. This score often qualifies you for competitive interest rates and more favorable terms, positively impacting your overall financial health and borrowing power.

While 715 is a strong score, it also serves as a great foundation for future growth. With continued positive financial behavior, you are well-positioned to climb into the "very good" or even "excellent" tiers. Moving up can unlock the most premium financial products and the lowest possible interest rates, opening doors to more significant long-term opportunities and savings.

Who Has a 715 Credit Score?

Credit scores tend to improve with age, as people have more time to establish a positive payment history and build a longer credit file. Here is a look at the average credit scores by generation based on 2023 data from Experian:

- Generation Z (ages 18-26): 680

- Millennials (ages 27-42): 690

- Generation X (ages 43-58): 709

- Baby Boomers (ages 59-77): 745

- Silent Generation (ages 78+): 760

Credit Cards With a 715 Credit Score

A credit score of 715 places you firmly in the 'good' credit category, which significantly boosts your chances of approval for a new credit card. With this score, you'll likely qualify for a wide array of cards, including many that offer attractive rewards like cash back or travel points. While the most premium, top-tier cards might still require a higher score, a 715 score makes you a desirable applicant for most lenders.

Kudos offers tools like the Explore Tool to help you find the right card by matching your stated preferences with its database of nearly 3,000 options. For a more tailored approach, its Dream Wallet feature can analyze your real spending habits to provide hyper-personalized recommendations that align with your financial situation.

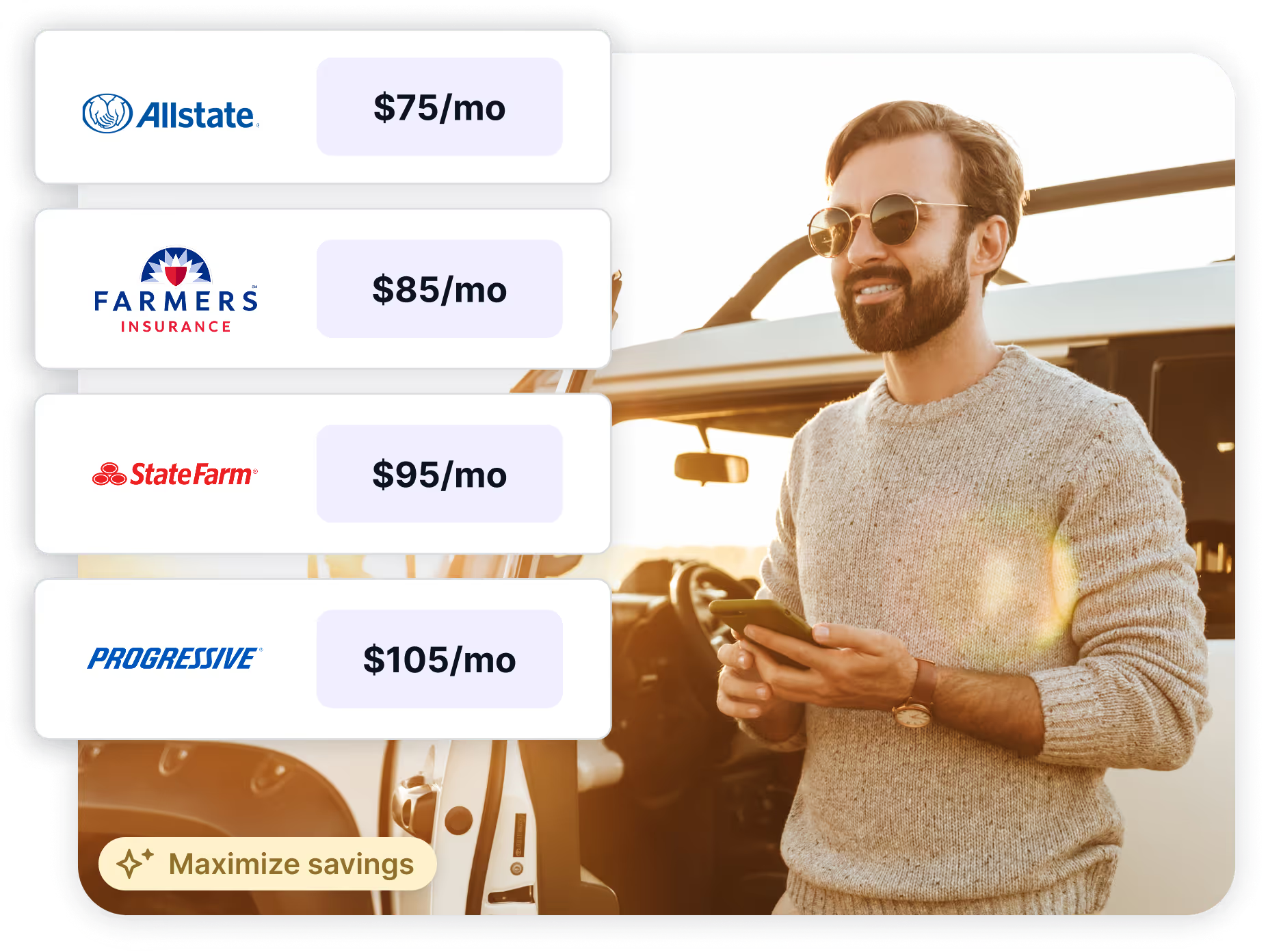

Auto Loans and a 715 Credit Score

A 715 credit score places you in the prime borrower category, meaning you'll likely be approved for an auto loan with competitive terms. According to a 2025 guide on auto loans, you can expect favorable interest rates, though they won't be as low as those for super-prime borrowers.

- Super-prime (781-850): 5.25% for new cars and 7.13% for used cars.

- Prime (661-780): 6.87% for new cars and 9.36% for used cars.

- Non-prime (601-660): 9.83% for new cars and 13.92% for used cars.

- Subprime (501-600): 13.18% for new cars and 18.86% for used cars.

- Deep subprime (300-500): 15.77% for new cars and 21.55% for used cars.

Mortgages at a 715 Credit Score

A 715 credit score is considered good and positions you well for a mortgage. You'll find that you meet the minimum credit score requirements for nearly all mainstream loan products. This includes conventional, jumbo, FHA, VA, and USDA loans, giving you a wide array of options to explore with potential lenders.

Beyond just qualifying, your 715 score positively impacts your loan terms. Lenders view you as a less risky borrower, which often translates to a smoother underwriting process and a better interest rate than someone with a score in the low 600s. You may also benefit from lower Private Mortgage Insurance (PMI) premiums if your down payment is less than 20%.

What's in a Credit Score?

Figuring out what goes into your credit score can feel like trying to solve a complex puzzle, but it generally boils down to a handful of key factors.

Your payment history tracks whether you've paid past credit accounts on time.

Credit utilization is the percentage of your available credit that you're currently using.

The length of your credit history considers the age of your oldest account, newest account, and the average age of all your accounts.

Credit mix refers to the variety of credit products you have, such as credit cards, retail accounts, installment loans, and mortgages.

New credit accounts for how many new accounts you've recently opened and the number of hard inquiries on your report.

How to Improve Your 715 Credit Score

A 715 credit score is a solid starting point, and improving it is entirely achievable through consistent, positive financial behaviors. According to a comprehensive guide, taking deliberate steps can help you build a healthier credit profile and reach higher score tiers.

- Monitor your credit reports regularly. This allows you to identify and dispute any inaccuracies that might be holding your score back from the "very good" or "excellent" range. Ensuring your report is error-free is a foundational step to reflect your true creditworthiness.

- Establish automatic bill payments. Payment history is the most significant factor in your score, so automating payments guarantees you maintain a perfect on-time record. This protects your good score from accidental late payments, which can cause a significant drop.

- Reduce your credit utilization ratio. While a 715 score suggests you're managing utilization well, lowering it further below the recommended 30% can provide a substantial boost. This demonstrates to lenders that you manage debt responsibly, not just that you have access to credit.

- Diversify your credit mix. Lenders prefer to see a history of managing different types of credit, like credit cards and installment loans. If your score is built on only one type of account, adding another can show you can handle various financial products, strengthening your profile over time.

For a smart assistant that helps you manage your cards and monitor your score, consider using the Kudos browser extension.

Supercharge Your Credit Cards

Experience smarter spending with Kudos and unlock more from your credit cards. Earn $20.00 when you sign up for Kudos with "GET20" and make an eligible Kudos Boost purchase.

Editorial Disclosure: Opinions expressed here are those of Kudos alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.