Kudos has partnered with CardRatings and Red Ventures for our coverage of credit card products. Kudos, CardRatings, and Red Ventures may receive a commission from card issuers. Kudos may receive commission from card issuers. Some of the card offers that appear on Kudos are from advertisers and may impact how and where card products appear on the site. Kudos tries to include as many card companies and offers as we are aware of, including offers from issuers that don't pay us, but we may not cover all card companies or all available card offers. You don't have to use our links, but we're grateful when you do!

How Many Credit Cards Should You Have?

July 1, 2025

Can you have too many credit cards? The short answer is — it depends. The average American has four cards. That can seem like a lot for some people, while others carry 10 or more. For the tradeoff — potential credit score ding and more complicated finances — having multiple credit cards can generate rewards and cashback for money you already spend.

Maximizing the benefits of carrying multiple cards means having the right cards for your lifestyle. That means you might need just four — while others will opt for more to really optimize their spending.

Multiple credit cards can help or hurt your credit score — and what really matters is how you manage them. In this article, we’ll discuss the pros and cons of having multiple credit cards and how this will affect your credit.

Will Having a Lot of Credit Cards Hurt Your Credit Score?

There’s no such thing as too many cards, at least from a long-term credit score standpoint. In other words, your credit score won’t take a hit by simply having too many cards. Your payment history and just how much credit card debt you have (relative to your total available credit limits) will play a much bigger role in your credit score.

Your credit utilization rate is the amount of credit you’re using compared (your credit card balances) relative to your total credit limits. For example, if you have three cards and the total balance on those cards is $1,000, while the total credit limit of the three is $5,000, your credit utilization ratio is 20%.

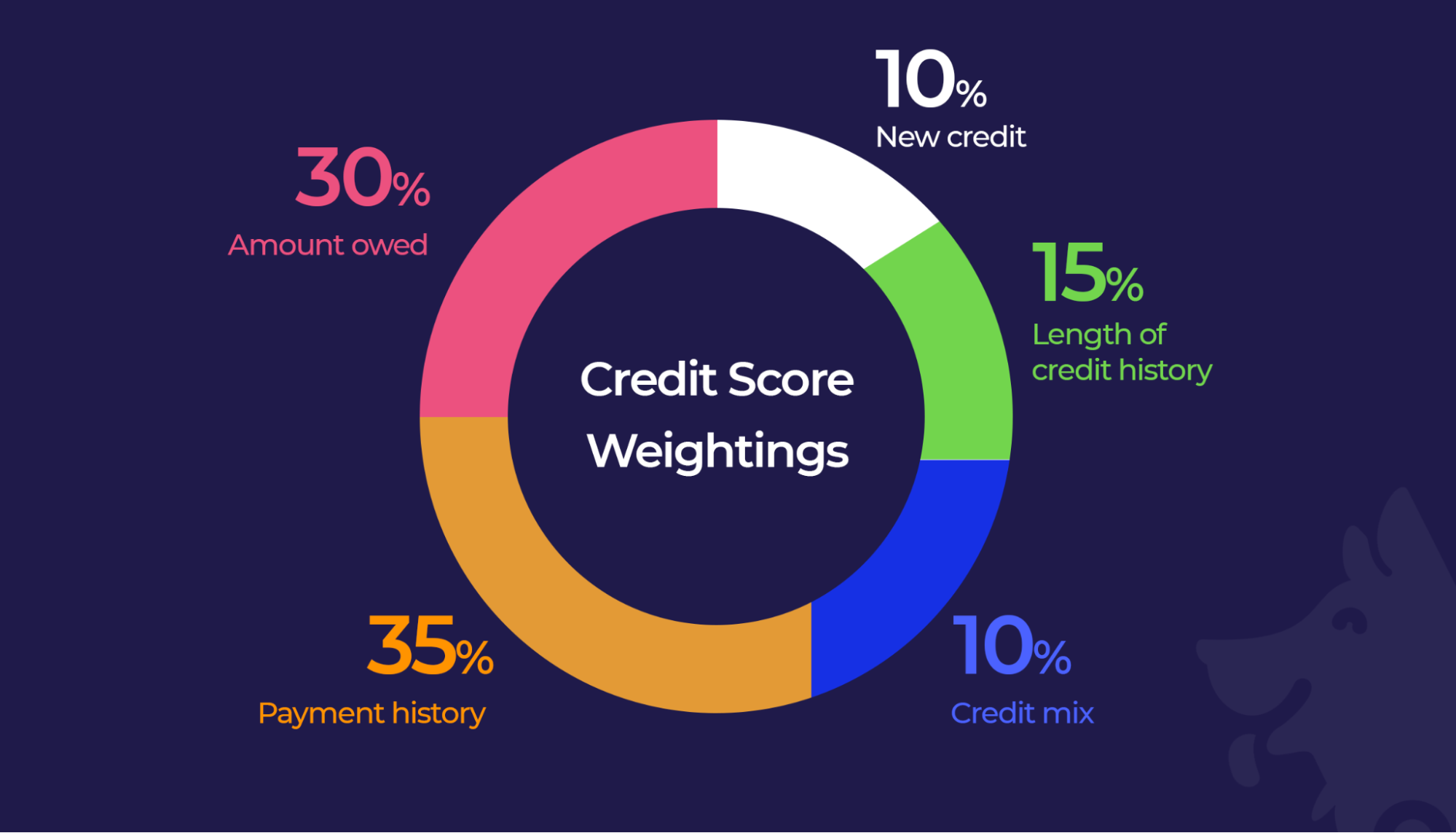

The credit utilization rate accounts for 30% of your credit score. Payment and credit history, which includes paying your bills on time, accounts for 35% of your credit score. In other words, worry less about the number of cards you have and more about keeping your balances relatively low and paying on time.

Credit score benefits of multiple cards

On the other hand, you can have too few credit cards. Having just one or two cards could hold your credit score and profile back. Just a few credit card accounts means scoring models will have a difficult time coming up with a score.

Credit bureaus look for a solid credit mix — different types of loans and credit lines. Ideally, you should have five or more accounts reporting on your credit report. Anything less, and you’ll be considered to have a “thin” credit profile.

When it comes to credit cards, applying for multiple cards in a short period can ding your credit score. However, while opening new cards can ding your credit temporarily, it can boost your credit score over time.

Fewer cards also mean you’re likely spending a large part of your total credit limits, increasing your credit utilization ratio. Additional cards will increase your overall credit available and lower your credit usage ratio.

For example, you have two cards — one with a $1,000 credit limit and another with a $3,000 limit. On the $1,000 card, you have an $800 balance, while the $3,000 card has a $1,900 balance. Your credit usage is 67.5%. That is, with a total balance owed of $2,700, you’re using 67.5% of your total credit limit of $4,000.

If you add an additional credit card with a $1,000 credit limit and don’t add a balance, your credit utilization ration becomes 54% despite maintaining the same overall balance.

Applying for Multiple Credit Cards

If you are getting ready to apply for several new cards, it’s best to spread out the credit applications to (1) minimize the hit to your credit score and (2) increase your likelihood of being approved.

A lot of hard credit inquiries on your credit report suggest you’re aggressively looking for new credit, which issuers may see as risky behavior.

Opening several new cards in a short period increases your new credit, which accounts for 10% of your credit score. But it also lowers the average age of your credit cards, which is 15% of your score.

How often should you apply for a new card?

One strategy is to time applications with big purchases. If you have big-ticket purchases coming up, such as furnishing a home, you may want to align your application with such purchases to maximize rewards and take advantage of signup bonuses.

Signup bonuses generally offer a reward, such as cash back or points, for spending a certain amount on the card in a set period. For example, a card issuer may offer a signup bonus of $200 if you put $1,000 in purchases on the card in the first three months.

Many people churn credit cards to secure these signup bonuses. Credit card churning involves applying for a credit card to get the bonus, but then downgrading or canceling the card.

Note that a lot of credit card issuers, such as American Express, have put rules in place to prevent consumers from applying for multiple credit cards in a short time. The credit card company Chase has a 5/24 policy, where if you apply for a Chase card and have opened over five cards in the past two years, you’ll be denied — regardless of your credit score.

Another rule is to avoid applying for new credit cards when you’re also considering another line of credit, such as a mortgage or car loan. Holding off on applying for additional credit cards while you’re making that application will increase the likelihood of it being approved.

Pros and Cons of Having Multiple Cards

A man in India holds the world record for having the most credit cards — 1,638. That’s a bit excessive, but most people carry multiple cards because they can maximize the benefits and rewards on spending they’re already doing — or plan to do. The downside of having multiple cards is that it gets more difficult to track debt and repayment dates. Some credit cards also attract annual fees, which can soon add up if you have a lot of cards.

Pros

- Can boost your credit profile

- Maximizes rewards and benefits

- Can lower credit usage ratio

- Signup bonuses

Cons

- Tough to keep track of multiple payments

- Potential multiple annual fees

- Can be detrimental to credit score

- Easier to spend beyond your means

Choosing Your Next Credit Card

The possibilities are almost endless these days when it comes to credit cards. There are cards that offer perks and points for flying, cashback on purchases, and signup bonuses or rewards.

Many credit cards offer specialized categories, where they earn above-average cashback or rewards for certain transactions, such as gas or grocery spending. You can find relatively high cashback, 5% or higher, on cards that offer rotating categories that can change every month or quarter. You can use the Kudos card explorer tool to to easily search for and filter credit cards based on these categories and features.

For those that like to keep it simple, there are cards that offer 2% cashback on all transactions rather than higher levels for certain categories. If you’re just starting, such as getting your first credit card, it’s best to select a cashback card with no annual fee.

A blend of different rewards will help you take full advantage of your spending. When it comes to picking a credit card, it’s best to consider how you’ll use that card — think about where you do most of your spending.

Let’s say you have $4,000 per month in credit card spending — 15% of that is for travel, 15% is for online shopping, 10% on eating out, 10% at grocery stores, 10% on clothing, 10% on home improvement, 5% on entertainment, 5% on gas, and another 20% on general spending.

Even if you just use a flat 2% cashback card for all your monthly card spending, that’s almost $1,000 a year in cash just for using your card. Now, if you go the multiple card route, you can optimize your credit card portfolio to get a much higher rate on some of those categories, such as 4% on dining out, 6% on groceries, 5% on home improvement, 5% on gas, etc. With just a little work, you can likely get the amount of rewards or cashback you’re earning on your monthly spend up to 4% — which would mean $2,000 a year in cash or rewards.

The general rule is to stick to cards where you can take advantage of the rewards offered. If you have a card with an annual fee, make sure you can get enough rewards or benefits from their use to cover the annual fee.

For the most part, if you keep a credit mix of five or more accounts, make your monthly payments on time, and keep your credit usage ratio below 30%, you shouldn’t have an issue qualifying for just about any credit card.

Which Credit Card Should You Be Using?

There's no one-size-fits-all when it comes to which card you should get or how many you should have. With multiple credit cards, you’ll have to remember which cards to use where. To truly make your credit cards work for you, sign up for Kudos. Kudos helps you effortlessly choose the right credit card for each purchase so you can maximize your rewards and benefits.

Unlock your extra benefits when you become a Kudos member

Turn your online shopping into even more rewards

Join over 400,000 members simplifying their finances

Editorial Disclosure: Opinions expressed here are those of Kudos alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

.webp)

.webp)