Kudos has partnered with CardRatings and Red Ventures for our coverage of credit card products. Kudos, CardRatings, and Red Ventures may receive a commission from card issuers. Kudos may receive commission from card issuers. Some of the card offers that appear on Kudos are from advertisers and may impact how and where card products appear on the site. Kudos tries to include as many card companies and offers as we are aware of, including offers from issuers that don't pay us, but we may not cover all card companies or all available card offers. You don't have to use our links, but we're grateful when you do!

753 Credit score: What You Need to Know in 2025

July 1, 2025

TL;DR

A 753 credit score is an excellent achievement, placing you in a strong position to qualify for a wide array of financial products. This score falls squarely within the 'Very Good' FICO range, which typically unlocks access to more competitive interest rates and premium credit opportunities.

What Does a 753 Credit Score Mean?

A credit score of 753 places you firmly in the "Very Good" range according to the FICO scoring model. Lenders view this score favorably, seeing you as a reliable and low-risk borrower. This means you'll likely qualify for competitive interest rates on loans and credit cards, potentially saving you a significant amount of money over the life of a loan. It's a strong financial position that opens doors to many credit products and favorable terms.

While a 753 score is excellent, it also represents a great launching point for reaching the highest tier of creditworthiness. With continued responsible financial habits, you're well-positioned to see your score climb into the "Exceptional" category, which starts at 800. This upward mobility can unlock even better financial opportunities and the most premium lending products available in the future.

Who Has a 753 Credit Score?

While age isn't a direct factor in credit scoring, there is a clear correlation showing that scores tend to improve as people get older. This is largely because older consumers have had more time to build a positive payment history and a longer credit history. Based on 2023 Experian data, here is the breakdown of average FICO scores by generation:

- Generation Z (ages 18-26): 680

- Millennials (ages 27-42): 690

- Generation X (ages 43-58): 709

- Baby Boomers (ages 59-77): 745

- Silent Generation (ages 78+): 760

Credit Cards With a 753 Credit Score

With a 753 credit score, you're in a strong position when it comes to applying for new credit cards. Lenders view this score favorably, meaning you have a high likelihood of being approved for a wide variety of cards. This includes premium options that often come with better interest rates, higher credit limits, and more attractive rewards programs.

Kudos helps you find the perfect credit card through personalized recommendation tools that analyze your unique financial situation and preferences to match you with the best options from a database of nearly 3,000 cards. The platform also provides insights into how a new card might impact your credit and whether an annual fee is justified based on your spending, helping you make a confident decision.

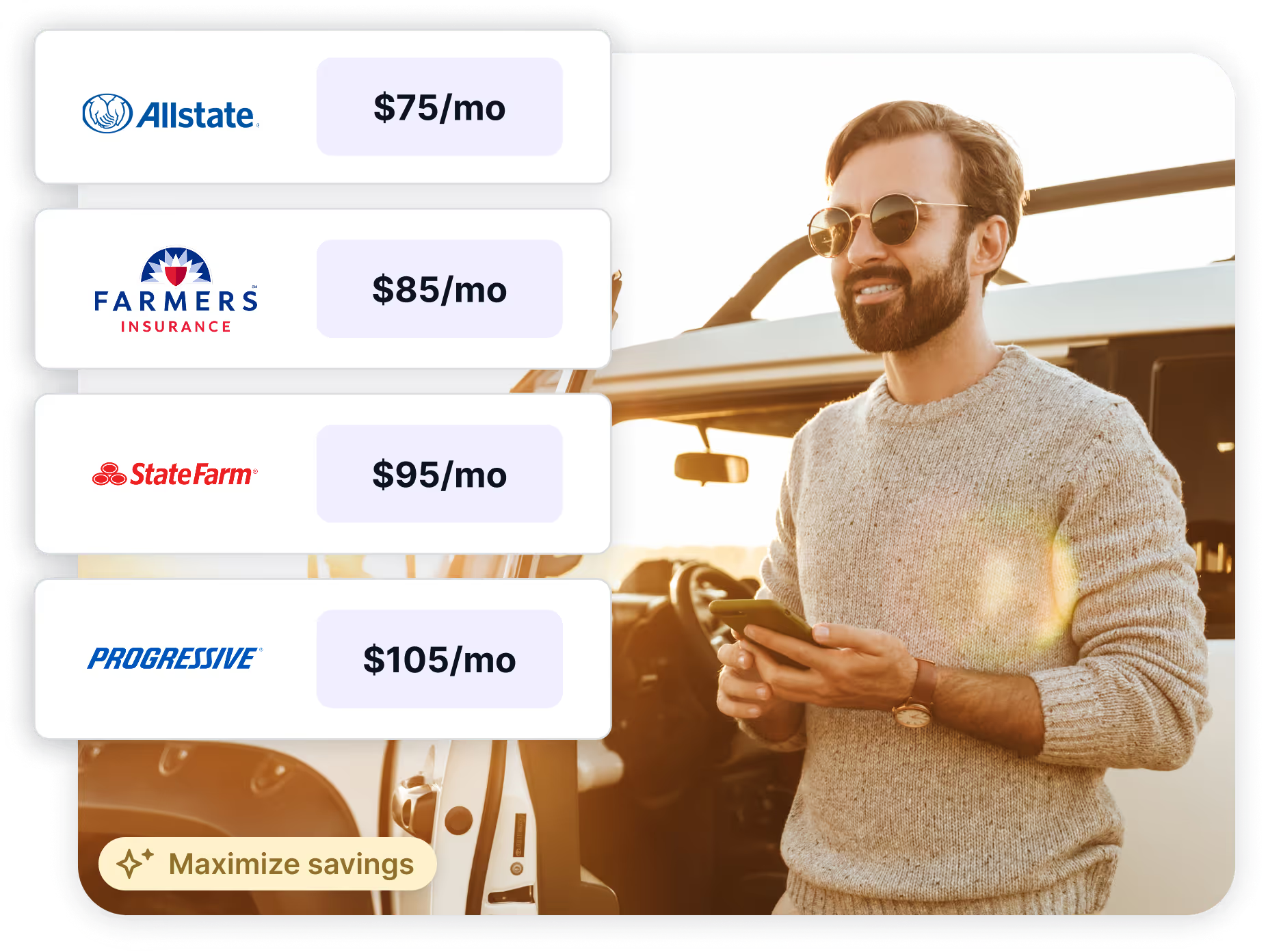

Auto Loans and a 753 Credit Score

With a 753 credit score, you fall squarely into the prime borrower category, which significantly boosts your chances of getting approved for an auto loan. Lenders view this score favorably, meaning you'll likely be offered competitive interest rates that are much lower than those for non-prime or subprime borrowers.

Based on Experian's Q2 2025 data, here is a breakdown of average rates:

- Super-prime (781-850): 5.25% for new cars and 7.13% for used cars.

- Prime (661-780): 6.87% for new cars and 9.36% for used cars.

- Non-prime (601-660): 9.83% for new cars and 13.92% for used cars.

- Subprime (501-600): 13.18% for new cars and 18.86% for used cars.

- Deep subprime (300-500): 15.77% for new cars and 21.55% for used cars.

Mortgages at a 753 Credit Score

A 753 credit score is considered excellent and will qualify you for all major mortgage products. Lenders view you as a low-risk borrower, so you'll easily meet the minimum credit score requirements for Conventional, Jumbo, FHA, VA, and USDA loans. This opens up a wide range of options and makes loan approval highly likely.

Beyond just qualifying, your score has a significant positive impact on loan terms. You can expect to secure some of the best interest rates available, which can save you tens of thousands of dollars over the loan's lifetime. Additionally, for conventional loans with less than 20% down, a high score reduces your Private Mortgage Insurance (PMI) premiums.

What's in a Credit Score?

Figuring out what goes into your credit score can feel like trying to solve a complex puzzle, but the number is generally derived from a few key factors in your financial history.

- Your payment history is the most significant factor, reflecting whether you pay your bills on time.

- Credit utilization measures how much of your available credit you are currently using.

- The length of your credit history considers the age of your oldest and newest accounts, as well as the average age of all your accounts.

- Your credit mix looks at the different types of credit you have, such as credit cards, mortgages, and installment loans.

- New credit inquiries and recently opened accounts can also temporarily impact your score.

How to Improve Your 753 Credit Score

No matter your starting point, it is always possible to improve your credit score and reach the highest tiers of financial health. For someone with a very good score of 753, the goal is to make strategic adjustments to achieve an excellent rating.

- Monitor your credit reports. Regularly reviewing your reports helps you catch and dispute inaccuracies or signs of fraud that could be holding your score back. This vigilance is key to protecting your high score and pushing it into the excellent range.

- Lower your credit utilization. Even with a good score, your utilization ratio is a powerful lever that can move you from 'very good' to 'excellent'. Keeping your balance well below 30% of your limit signals strong financial management to lenders.

- Diversify your credit mix. A 753 score is strong, but showing you can responsibly handle different credit types, like installment loans and revolving credit, adds depth to your profile. This demonstrates to lenders that you are a well-rounded, low-risk borrower.

- Limit hard inquiries. Applying for new credit too frequently can cause small dips that prevent you from reaching the 800+ range. Limiting hard inquiries protects your score from unnecessary dings and shows lenders you aren't desperately seeking credit.

Kudos offers a suite of tools to help you manage your cards, monitor your score, and maximize rewards as you build your credit.

Supercharge Your Credit Cards

Experience smarter spending with Kudos and unlock more from your credit cards. Earn $20.00 when you sign up for Kudos with "GET20" and make an eligible Kudos Boost purchase.

Editorial Disclosure: Opinions expressed here are those of Kudos alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.