Kudos has partnered with CardRatings and Red Ventures for our coverage of credit card products. Kudos, CardRatings, and Red Ventures may receive a commission from card issuers. Kudos may receive commission from card issuers. Some of the card offers that appear on Kudos are from advertisers and may impact how and where card products appear on the site. Kudos tries to include as many card companies and offers as we are aware of, including offers from issuers that don't pay us, but we may not cover all card companies or all available card offers. You don't have to use our links, but we're grateful when you do!

754 Credit score: What You Need to Know in 2025

July 1, 2025

TL;DR

A 754 credit score is a strong score that positions you well for attractive loan terms and financial products. This places you firmly in the "Very Good" FICO score range, signaling to lenders that you are a reliable borrower.

What Does a 754 Credit Score Mean?

A credit score of 754 places you firmly in the "very good" range on the FICO Score scale, which runs from 300 to 850. This score indicates a history of responsible credit management and puts you in a strong position financially, well above the national average. Lenders view a score like this as a sign of a reliable borrower, signaling low risk and a consistent track record of paying bills on time.

Financially, this score unlocks better approval odds and more favorable interest rates for mortgages, auto loans, and credit cards. While it's an excellent score that demonstrates strong financial habits, it also serves as a great foundation for maintaining your credit health and potentially reaching the top-tier "exceptional" category in the future.

Who Has a 754 Credit Score?

While individual scores vary, data from Experian shows a clear trend of credit scores increasing with age. Here is the average FICO score by generation for 2023:

- Generation Z (ages 18-26): 680

- Millennials (ages 27-42): 690

- Generation X (ages 43-58): 709

- Baby Boomers (ages 59-77): 745

- Silent Generation (ages 78+): 760

Credit Cards With a 754 Credit Score

With a 754 credit score, you're in a strong position when it comes to applying for a new credit card. Lenders generally consider this a very good score, significantly boosting your approval odds for a wide array of credit cards, including top-tier rewards and travel cards. This also means you're more likely to qualify for favorable terms like lower annual percentage rates (APRs) and higher credit limits right from the start.

Kudos offers tools like the Explore Tool, which personalizes recommendations based on your preferences and financial goals. For a deeper analysis, its Dream Wallet feature analyzes your spending to provide insights on how a new card might impact your credit score and whether premium annual fees are worthwhile for you.

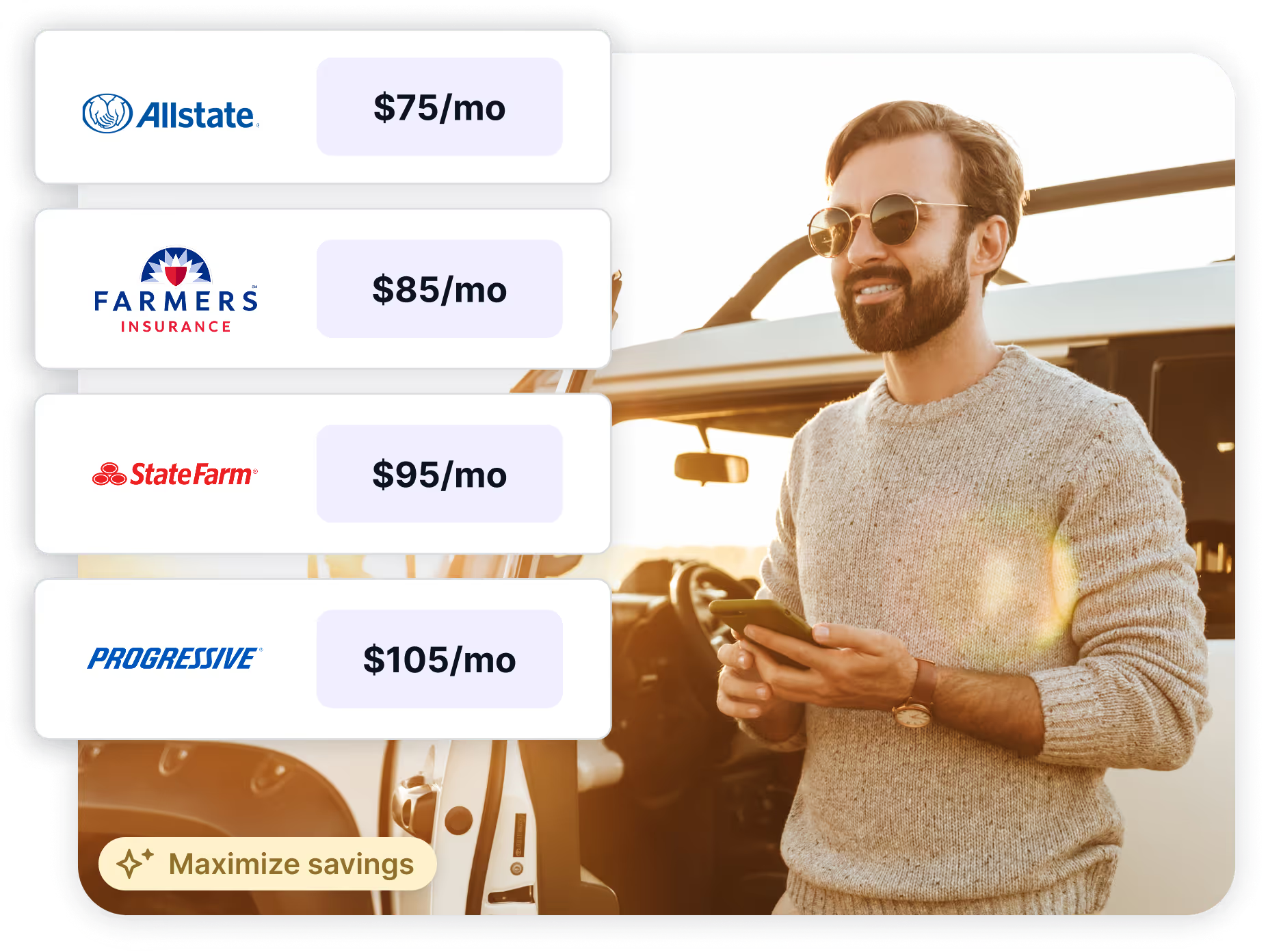

Auto Loans and a 754 Credit Score

A 754 credit score is considered very good, placing you in a strong position for auto loan approval. While you'll likely qualify for competitive interest rates, the very best rates are typically reserved for those with super-prime scores above 780.

According to Experian's Q2 2025 data, average auto loan rates break down as follows:

- Super-prime (781-850): 5.25% for new cars, 7.13% for used cars

- Prime (661-780): 6.87% for new cars, 9.36% for used cars

- Non-prime (601-660): 9.83% for new cars, 13.92% for used cars

- Subprime (501-600): 13.18% for new cars, 18.86% for used cars

- Deep subprime (300-500): 15.77% for new cars, 21.55% for used cars

Mortgages at a 754 Credit Score

A 754 is an excellent credit score that qualifies you for all major mortgage types, including conventional, jumbo, FHA, VA, and USDA loans. Lenders view you as a low-risk borrower, making approval highly likely and giving you a wide range of loan products to choose from.

This strong score directly translates to significant financial benefits. You can expect to receive some of the lowest available interest rates, saving you thousands over the loan's term. For conventional loans with a smaller down payment, you may also secure lower Private Mortgage Insurance (PMI) premiums, further reducing your monthly costs.

What's in a Credit Score?

Figuring out what goes into your credit score can feel like trying to solve a complex puzzle, but it generally boils down to a handful of key elements. The most common factors include:

- Your history of making payments on time is the most significant factor.

- How much of your available credit you're currently using, known as your credit utilization ratio, plays a major role.

- The age of your credit accounts, including the average age and the age of your oldest account, is also considered.

- Lenders like to see that you can responsibly manage different types of credit, such as credit cards and loans.

- Opening several new credit accounts in a short period can be seen as a risk and may temporarily lower your score.

How to Improve Your 754 Credit Score

Even with a very good score of 754, improving your credit is always possible through consistent, positive financial behavior. According to a guide on increasing credit scores, most people can see meaningful changes within three to six months by taking the right steps.

- Reduce your credit utilization ratio. Keeping your utilization low, ideally below 10% for top scores, can help push your score from the 'very good' category into the 'excellent' range. This is one of the most effective ways to fine-tune an already strong credit profile.

- Monitor your credit reports regularly. Checking your reports ensures that no errors or fraudulent activity can unexpectedly lower your score. This proactive step helps you maintain your high score and identify opportunities for further improvement.

- Limit hard inquiries. Avoiding unnecessary credit applications prevents temporary dips in your score that come with hard inquiries. This is especially important for maintaining a high score when you plan to apply for major credit, like a mortgage.

- Diversify your credit mix. If your credit profile lacks variety, such as having only credit cards and no installment loans, adding a different type of credit can provide a small boost. Lenders view a diverse mix as a sign of responsible credit management.

An AI-powered tool like Kudos can serve as your financial companion to help you manage your credit and maximize rewards.

Supercharge Your Credit Cards

Experience smarter spending with Kudos and unlock more from your credit cards. Earn $20.00 when you sign up for Kudos with "GET20" and make an eligible Kudos Boost purchase.

Editorial Disclosure: Opinions expressed here are those of Kudos alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.