Kudos has partnered with CardRatings and Red Ventures for our coverage of credit card products. Kudos, CardRatings, and Red Ventures may receive a commission from card issuers. Kudos may receive commission from card issuers. Some of the card offers that appear on Kudos are from advertisers and may impact how and where card products appear on the site. Kudos tries to include as many card companies and offers as we are aware of, including offers from issuers that don't pay us, but we may not cover all card companies or all available card offers. You don't have to use our links, but we're grateful when you do!

781 Credit score: What You Need to Know in 2025

July 1, 2025

TL;DR

A 781 credit score is an excellent score that signals strong creditworthiness to lenders. This places you squarely in the "Very Good" range of FICO scores, unlocking favorable interest rates and premium financial products.

What Does a 781 Credit Score Mean?

A credit score of 781 is a strong indicator of your financial health. Within the FICO scoring model, which ranges from 300 to 850, a 781 score falls squarely into the "very good" category. Lenders view individuals with scores in this range as highly responsible borrowers. This means you'll likely have access to a wider array of financial products, from credit cards to loans, often with more favorable interest rates and terms.

While a 781 score already unlocks significant financial opportunities, there's still a path forward. Maintaining positive credit habits can help preserve this strong standing. For those aiming for the top-tier "exceptional" category (800+), continued responsible financial management can pave the way. This excellent foundation puts you in a great position to achieve future financial goals.

Who Has a 781 Credit Score?

While a 781 credit score is well above average for any age demographic, scores generally improve over time. According to 2023 Experian data, the average FICO score tends to rise with each generation. Here is the breakdown by age group:

- Generation Z (ages 18-26): 680

- Millennials (ages 27-42): 690

- Generation X (ages 43-58): 709

- Baby Boomers (ages 59-77): 745

- Silent Generation (ages 78+): 760

Credit Cards With a 781 Credit Score

A credit score of 781 places you firmly in the excellent credit category, opening the door to some of the most desirable credit cards on the market. Lenders view this score as a sign of exceptional financial responsibility, which means you'll likely be approved for premium rewards cards, cards with lucrative sign-up bonuses, and those offering long 0% introductory APR periods. Essentially, a score this high gives you a significant advantage, allowing you to be selective and choose the card that best fits your financial goals.

Kudos can help you find the perfect card with its personalized recommendation engine, the Explore Tool, which matches cards to your stated preferences. For an even more tailored approach, the Dream Wallet feature analyzes your real-time spending data to suggest cards that fit your financial habits, complete with insights on potential credit score impacts.

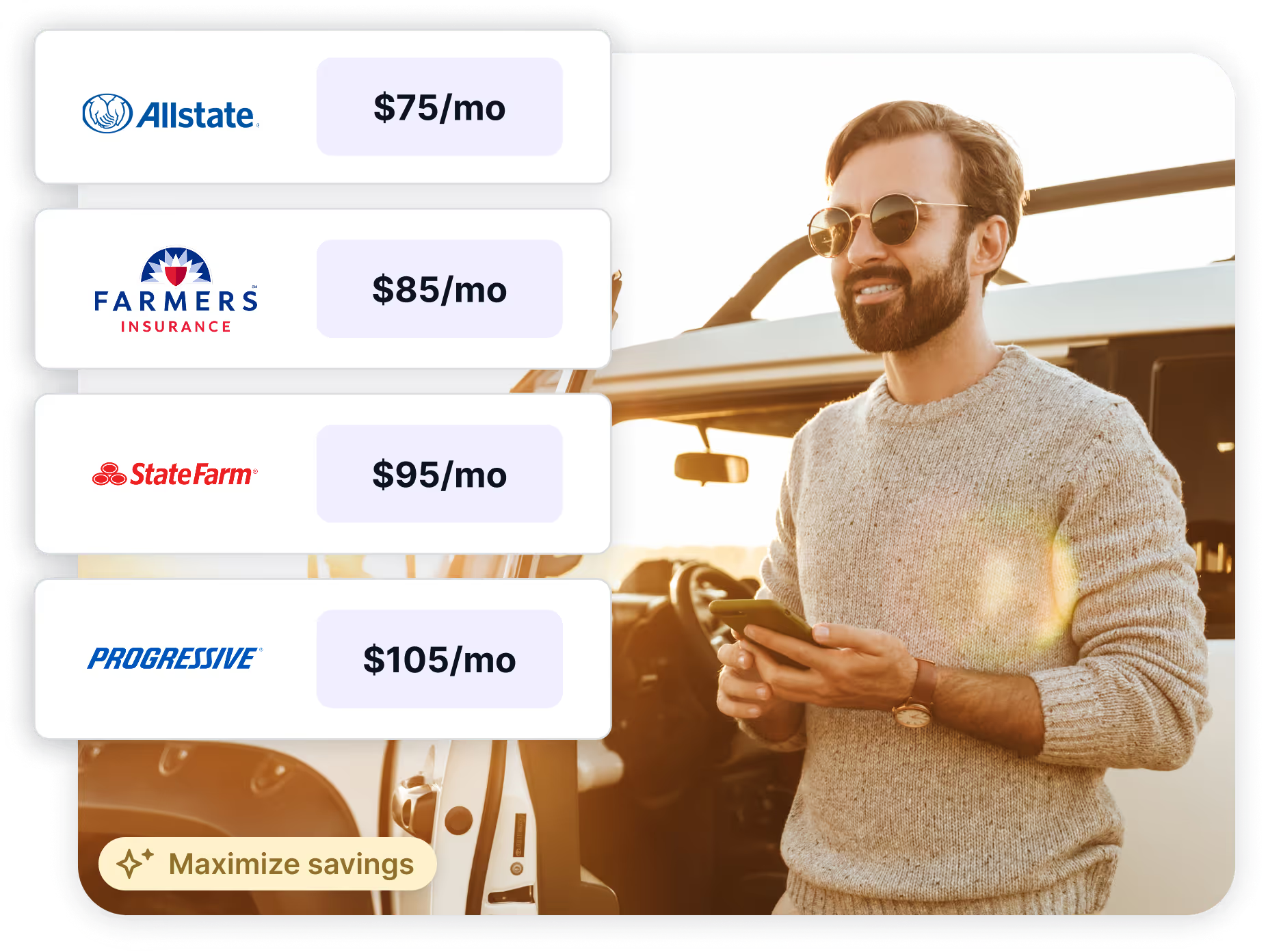

Auto Loans and a 781 Credit Score

A 781 credit score places you in the top tier of borrowers, making you a highly attractive candidate for an auto loan. Lenders will likely offer you their most competitive interest rates and favorable terms, ensuring you get the best possible deal on your financing.

According to a 2025 guide, here are the average auto loan interest rates for new and used cars by credit score bracket:

- Super-prime (781-850): 5.25% for new cars and 7.13% for used cars

- Prime (661-780): 6.87% for new cars and 9.36% for used cars

- Non-prime (601-660): 9.83% for new cars and 13.92% for used cars

- Subprime (501-600): 13.18% for new cars and 18.86% for used cars

- Deep subprime (300-500): 15.77% for new cars and 21.55% for used cars

Mortgages at a 781 Credit Score

A 781 credit score is considered excellent and positions you to qualify for nearly any home loan available. This includes all major mortgage types like Conventional, Jumbo, FHA, VA, and USDA loans. Because this score is well above the minimum requirements for each, lenders will view you as a low-risk borrower, significantly increasing your chances of a smooth underwriting process.

Your high score directly impacts the loan terms you'll receive. You can expect to be offered the most favorable interest rates, which can save you a substantial amount of money over the loan's lifetime. Other benefits include lower Private Mortgage Insurance (PMI) premiums and more negotiating power with lenders, who will be eager for your business.

What's in a Credit Score?

Figuring out what goes into your credit score can feel like trying to solve a complex puzzle, but it generally boils down to a handful of key factors.

Your payment history tracks whether you've paid past credit accounts on time.

Credit utilization is the percentage of your available credit that you're currently using.

The length of your credit history considers the age of your oldest account, newest account, and the average age of all your accounts.

Credit mix refers to the variety of credit products you have, such as credit cards, retail accounts, installment loans, and mortgages.

New credit accounts for how many new accounts you've recently opened and the number of hard inquiries on your report.

How to Improve Your 781 Credit Score

Even with a very good credit score of 781, it is always possible to improve your creditworthiness through consistent, positive financial behavior. Taking a few strategic steps can protect your score from unexpected drops and push it toward the excellent range using proven methods.

- Monitor your credit reports. Regularly checking your reports from all three bureaus helps you spot and dispute inaccuracies or signs of fraud that could otherwise damage your high score. This vigilance is key to maintaining your creditworthiness and tracking your progress.

- Establish automatic bill payments. For a high score, a single late payment can have a significant negative impact, making on-time payments the most crucial factor. Automating payments ensures you never miss a due date and protects the positive payment history you've already built.

- Reduce your credit utilization ratio. While your utilization is likely already low, keeping it well below the recommended 30% is vital for pushing a 781 score even higher. Paying down balances before your statement date can help maintain a minimal ratio and show lenders you use credit responsibly.

- Limit hard inquiries. Although you're likely to be approved for new credit, each application can cause a small, temporary dip in your score. Spacing out applications and using prequalification tools helps you avoid unnecessary inquiries that could chip away at your excellent standing.

Using a tool like Kudos can help you manage your credit cards, monitor your score, and maximize rewards all in one place.

Supercharge Your Credit Cards

Experience smarter spending with Kudos and unlock more from your credit cards. Earn $20.00 when you sign up for Kudos with "GET20" and make an eligible Kudos Boost purchase.

Editorial Disclosure: Opinions expressed here are those of Kudos alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.